Tomado de Blu Radio

08/09/2021

Key points of the Tax Reform approved by Congress

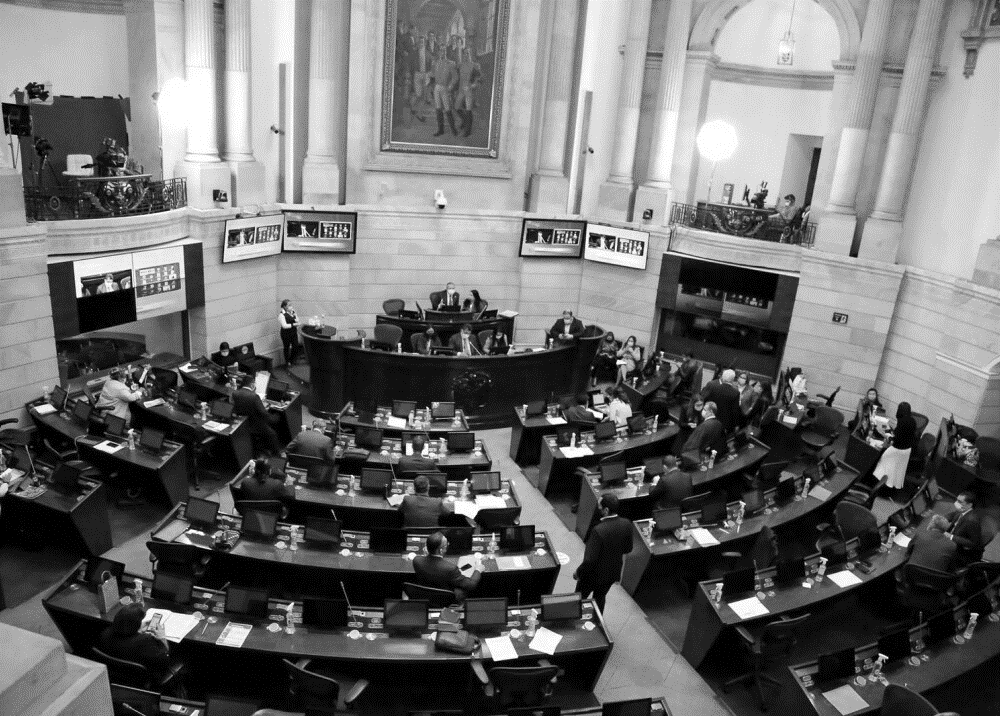

The “Social Investment Law” (Tax Reform), which seeks to raise 15.2 billion pesos, to clean up public finances affected by the pandemic and the financing of various social programs fundamental to economic recovery, was approved in an extensive session in the plenary sessions of the Senate and the House of Representatives. Now the two approved texts must be reconciled before becoming the Law of the Republic.

“This is a historic moment. We are seeing a social investment reform in which different actors from society have participated. With this vote of 124 votes to 8 we see that all the parties came together for a cause. This new law will respond to the needs urgent matters brought about by the pandemic, while generating permanent resources, honoring that tradition of responsibility in the management of public accounts, “said Finance Minister José Manuel Restrepo at the end of the discussion in the House of Representatives.

With the “Social Investment Law” programs such as Solidarity Income will be financed that will benefit 4.1 million families, the extension of the payroll subsidy until December 2021 that will help 60 thousand micro and small businesses and the payment of tuition for 695 thousand students.

These are the main points of the Tax Reform that was approved in the Congress of the Republic:

Financing

To achieve a collection of 15.2 trillion pesos, necessary to clean up public finances and reactivate the economy, the Government will resort to the formula proposed by the country’s businessmen and other alternatives that will not affect the middle class with new taxes.

- VAT tax: the Tax Reform will not make adjustments to VAT nor will it increase the taxable base of the personal income tax.

- Company income: the ICA discount will be maintained at 50%, not 100% as proposed in the 2019 Growth Law. With this measure, a collection of 3.9 billion pesos will be achieved.

- Solidarity contribution from companies: to collect 6.7 billion pesos, a 35% rate is established in the corporate income tax. On the other hand, the income surcharge of three percentage points is extended to the financial sector until 2025. Benefits of the previous Tax Reform are maintained, such as those related to the hiring of young people, the orange economy and exempt income for the agro-industrial sector and investments in hotels and parks.

- Austerity plan: through austerity initiatives in public spending, it is expected to finance 1.9 trillion pesos. Starting in 2023, the expenses of payroll financed with the public budget will not increase. In addition, expenditures on goods and services will be limited; Travel expenses, stationery, advertising, vehicles and fuel will be reduced by 50% in a period of 10 years and security schemes will be rationalized, among other measures.

- Fight against tax evasion: in the fight against tax evasion, the government plans to obtain 2.7 trillion pesos thanks to strategies such as the creation of the Single Registry of Final Beneficiaries (RUB) that will identify the beneficiaries of the companies so that they comply with your tax obligations.

- Economic reactivation measures: three days without VAT per year will be implemented, up to 50% of the operational deficit of the mass transportation systems will be financed and 2.4 trillion pesos will be delivered to the regions to invest in education and health.

Social programs

A fundamental point of the “Social Investment Law” is the financing of various social programs implemented by the National Government to help the most vulnerable population affected by the Covid-19 pandemic.

- Solidarity Income: this emergency basic income will be extended until December 2022 with the aim of protecting those who need it most, as this subsidy has allowed to maintain economic activity.

- Program (PAEF): the Social Investment Law expands the coverage of the payroll subsidy for micro-enterprises, by extending the scope to those with two workers. Currently, micro-enterprises with at least three employees can access the subsidy. The program is also extended for the period July-December 2021.

- Zero enrollment: the National Government aims to permanently free university enrollment for students from strata 1, 2 and 3 in public universities. It is proposed that this program becomes a new State policy.

- Promotion of youth and female employment: the project proposes a subsidy of 25% of the first minimum wage of workers between 18 and 28 years old who are hired by companies. In practice, this figure is equivalent to the amount of the employee’s social security. In addition, there will be tax incentives for companies that hire female heads of household.