Tomado de: El Tiempo

14/07/2021

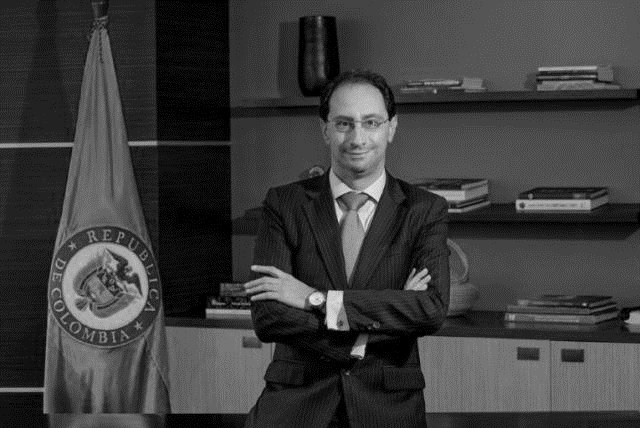

Minister of Finance presents the “Social Investment Law”

The Minister of Finance, José Manuel Restrepo, presented the guidelines of the “Social Investment Law” (Tax Reform) that will be filed in the Congress of the Republic on July 20 and whose main objective is to clean up public finances and reactivate the economy through the financing of social programs.

“The protection of the most vulnerable; obtaining resources through austerity and the fight against tax evasion; business solidarity for economic reactivation and fiscal stability are the four agreed lines for the social investment project ”, said Minister Restrepo at an event held at the Casa de Nariño together with President Iván Duque.

“The social is nothing different from serving the most vulnerable, because they continue to exist due to the impact of the pandemic and they need resources to survive. There are vulnerable young people who need access to higher education, and also entrepreneurs of all sizes ”, he added.

After meeting with more than 80 leaders in regional forums, the minister said that the new project will have an urgent message for the economic commissions to meet jointly and be approved in plenary sessions before August.

“Throughout a month and a half of listening and building consensus for the social investment project, it has become clear to us that what Colombians need and demand,” added the official who reiterated that the “Social Investment Project” will seek to collect approximately 15.2 billion pesos without affecting the middle class.

“It is important to note that the” Social Investment Law “does not touch the VAT tax, the pensions of Colombians, or the base of people who pay income tax. What we want is to protect the middle class, which is the engine of growth, ”said Restrepo, who also stressed that the project is the result of a broad consensus that has been built for several months.

The minister stressed that, on the road to economic reactivation, the National Government is making the first effort through an unprecedented austerity policy within the Public Administration. “The austerity policy constitutes between 15% and 20% of this initiative. Furthermore, combined with the fight against tax evasion, they constitute 40% of this project, ”said Restrepo.

The project will temporarily maintain some social aid that was given due to the impact of the pandemic on the income of thousands of Colombians and will leave other social initiatives as State policies.

In turn, President Iván Duque highlighted the importance of the “Social Investment Law” for Colombia to resume the path of growth truncated by the Covid-19 pandemic. “The pandemic hit us when we had outstanding regional growth. The challenge was to attend to the lives of people, but also of companies. Comprehensively protect society, “said the President.

“Today more than ever we have to take on the challenge that lies ahead. We need to maintain the social programs that have been created in these difficult times and for this a responsible financing law is necessary, ”said the President, who made a complete recount of the social programs implemented during the pandemic.

“This project would not be possible without the generosity of the private sector. Achieving this social agenda requires resources close to 15 billion pesos, which is more than what has been achieved in other Tax Reforms and without touching natural persons. The effort of the private sector is complemented by the Government’s austerity program to obtain clear goals in the short and medium term, ”said Duque.

“The Social Investment Law is supported by important decisions of the private sector and political decisions of the Government. I invite this debate to take place in Congress with a great sense of responsibility to respond to the demands of the population, ”the President pointed out.

Union leaders such as Julián Domínguez, president of Confecámaras and Bruce Mac Master, president of the National Association of Colombian Entrepreneurs (ANDI) were present at the presentation of the “Social Investment Law”.

“From the business sector we have made proposals aimed at getting the country out of the crisis, understanding that we could not go to the people so affected by the pandemic. In this sense, we understood that businessmen would have to make an effort for Colombia to maintain fiscal and social sustainability, ”said Bruce Mac Master, highlighting the patriotic spirit of businessmen.

Representing the mayors of the country, Gian Carlo Giorometa and Carlos Ordosgostia, local leaders of Mosquera, Cundinamarca and Montería, Córdoba, as well as the Governor of Cundinamarca Nicolás García participated. All highlighted the importance of the Tax Reform for the economic recovery of the regions.

On behalf of Congress, the House Representatives José Elver Hernández (president of the Fourth Commission), Néstor Leonardo Rico of the Radical Change Party, Jhon Jairo Cárdenas of the U Party, Senator María del Rosario Guerra of the Democratic Center Party, the Liberal Senator Mario Castaño, John Milton Rodríguez from Colombia Justa Libre.

The Congressmen pledged to bring out the best project for the good of the country and the reactivation of its economy without affecting the most vulnerable sectors. Similarly, they highlighted the work of Minister Restrepo to generate consensus and take into account the opinion of all social sectors. “We are committed to a responsible debate that will allow Colombia to get out of the crisis,” said Senator Guerra.

These are the main points of the “Social Investment Law”:

FINANCING

To achieve a collection of 15.2 trillion pesos, necessary to clean up public finances and reactivate the economy, the Government will resort to the formula proposed by the country’s businessmen and other alternatives that will not affect the middle class with new taxes.

- VAT tax: one of the aspects that are already clear is that the Reform will not make adjustments to VAT nor will it increase the taxable base of the personal income tax.

- Company income: the ICA discount will be maintained at 50%, not 100% as proposed in the 2019 Growth Law. With this measure, a collection of 3.9 billion pesos would be achieved.

- Solidarity contribution from companies: to collect 6.7 billion pesos, a 35% rate will be established in the corporate income tax. On the other hand, the income surcharge of three percentage points will be extended to the financial sector until 2025. Benefits from the previous Reform will be maintained, such as those related to the hiring of young people, the orange economy and exempt income for the agro-industrial sector and the investments in hotels and parks.

- Austerity plan: through austerity initiatives in public spending, it is expected to finance 1.9 trillion pesos. Starting in 2023, the expenses of payroll financed with the public budget will not increase. In addition, expenditures on goods and services will be limited; Travel expenses, stationery, advertising, vehicles and fuel will be reduced by 50% in a period of 10 years and security schemes will be rationalized, among other measures.

- Fight against tax evasion: in the fight against tax evasion, the Government plans to obtain 2.7 trillion pesos thanks to strategies such as the creation of the Single Registry of Final Beneficiaries (RUB) that will identify the beneficiaries of the companies so that they comply with your tax obligations. The georeferencing system will also be used to detect the real value of the declared properties.

- Economic reactivation measures: up to three days without VAT per year will be implemented, up to 50% of the operational deficit of mass transportation systems will be financed and 2.4 trillion pesos will be delivered to the regions to invest in education and health.

SOCIAL PROGRAMS

A fundamental point of the “Social Investment Law” (as its name indicates) in the financing of various social programs implemented by the National Government to help the most vulnerable population affected by the Covid-19 pandemic.

- Solidarity Income: it is proposed to extend this emergency basic income until the year 2022 with the aim of protecting those who need it most, since this subsidy has allowed to maintain economic activity.

- Program (PAEF): the Social Investment Law will expand the coverage of the payroll subsidy for micro-enterprises, by extending the scope to those with two workers. Currently, micro-enterprises with at least three employees can access the subsidy. The program is also extended for the period July-December 2021

- Zero enrollment: the National Government aims to permanently free university enrollment for students from strata 1, 2 and 3 in public universities. It is proposed that this program becomes a new State policy.

- Promotion of youth employment: the project proposes a subsidy of 25% of the first minimum wage of workers between 18 and 28 years old who are hired by companies. In practice, this figure is equivalent to the amount of the employee’s social security.

As established in the Medium-Term Fiscal Framework, the new Tax Reform must guarantee a stable debt path to avoid an increase in borrowing costs and maintain access to financial markets. This implies that the country’s income increases permanently by at least 1% or 1.2% of GDP, which would mean an increase of 10 or 12 trillion pesos annually, respectively.