04/08/2021

¿What will the General Budget for 2022 be like?

On June 29, the Minister of Finance presented to the Congress of the Republic the General Budget of the Nation for 2022. Unlike the Tax Reform, this project is governed by a Statute that establishes dates for its discussion and approval: before On September 15, the joint economic commissions of Congress (third and fourth) will decide the final amount of the spending budget; they must approve it before September 25, and the plenaries must begin their discussion before October 1 and issue it before midnight on October 20.

Knowing this, the economic commissions usually give priority in their agenda to the document of the General Budget. However, this time it will be left behind the Tax Reform project, to which the Government has given an urgent message. However, it is essential to know its content, as it will be the roadmap for public finances for the coming year.

¿How is the budget distributed?

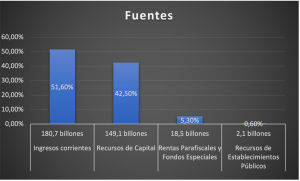

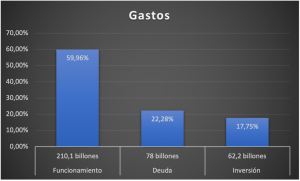

The project that the Ministry of Finance presented a few days ago is for $ 350.4 billion. How much was this year’s? Initially of $ 313.9 billion, but after several additions the budget that the country has managed in 2021 has been of $ 332.8 billion. So, the Budget for 2022 shows an increase of 5.3% compared to 2021. Where will the money come from and how will the expenses be distributed? Both categories are shown in the following graphs.

Data from the Ministry of Finance

Data from the Ministry of Finance

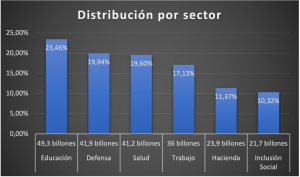

Regarding the traditional distribution by sectors, it is known that those that will have a larger fund will be Education, Defense and Health:

Data from the Ministry of Finance

Political environment

With the General Budget, congressmen have less room for maneuver than with an ordinary law. While with a tax reform, for example, parliamentarians can make changes that they see fit, in the General Budget they cannot increase the amount of any expenditure if they do not have the approval of the Minister of Finance; They cannot reduce expenses related to the payment of the public debt, and, if they do not issue it before midnight on October 20, the project presented by the government comes into force, only with the modifications made until the first debate by the commissions economic. In this sense, although a broad discussion is expected, it is also predicted that the General Budget will be issued without major controversies than those that the tax reform may generate.

[1]Decree 111 of 1996.